On May 23, local time, the US Commerce Department said it had signed a $75 million (about 10.15 billion won) preliminary transaction memorandum (PMT) under the CHIPS Act to provide funding to Absolics. This is the first company in the semiconductor raw material and component sector to receive government funding from the US government, apart from semiconductor chip manufacturers.

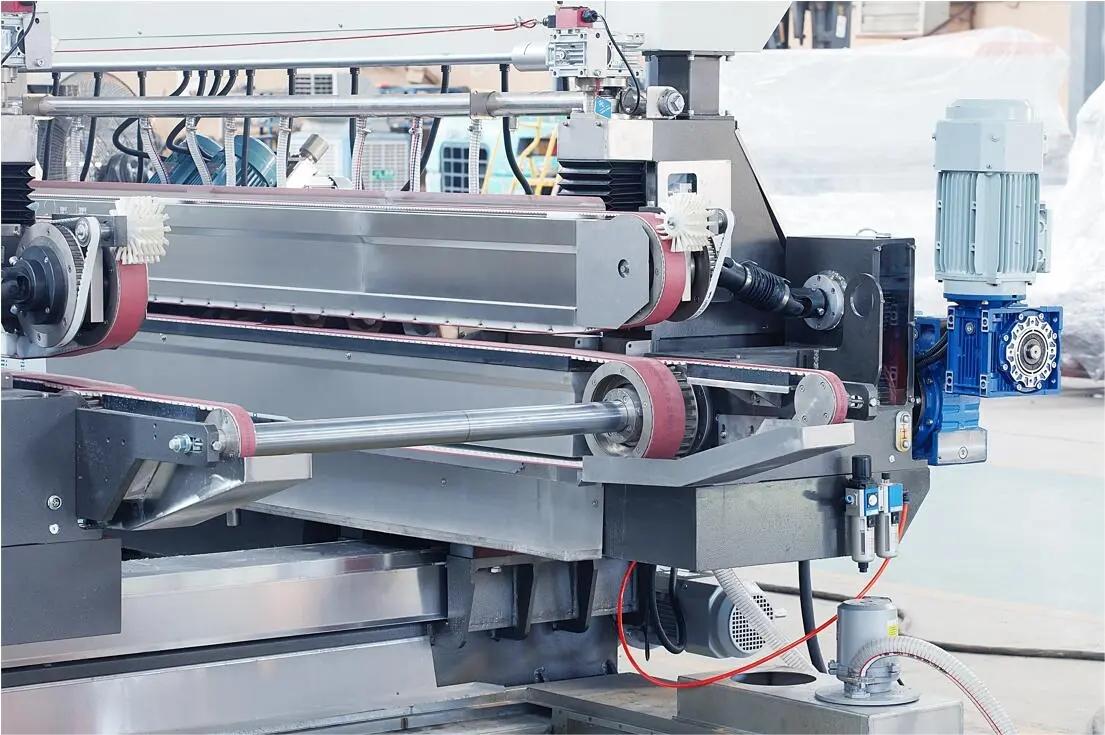

The funds will be used to build a 120,000-square-foot factory in Georgia, develop advanced packaging technology, and supply advanced materials to the US semiconductor industry. The subsidy to be granted to the semiconductor packaging supplier, Absolics, will come from the US government's $52.7 billion chip manufacturing and subsidy fund.

The subsidy is for Absolix Covington Glass Substrate Factory No. 1 located in Georgia. The $75 million subsidy is 25% of the total investment of $300 million. The first factory has an annual production capacity of 12,000 square meters and recently went into trial operation. The scheduled time for commercial mass production is the first half of next year.

Absolics also plans to advance the construction of Factory No. 2, with an annual production capacity of 72,000 square meters, which is expected to cost more than $400 million.

It is reported that Absolics was established in 2021 by SKC, a glass substrate manufacturer, and APPLIDE Materials (AMAT), a semiconductor equipment company. SKC is a subsidiary of SK Group, a South Korean conglomerate. SKC plans to use the grant as an opportunity to further accelerate its glass substrate business for artificial intelligence (AI) semiconductors and become a game-changer in the AI semiconductor ecosystem.

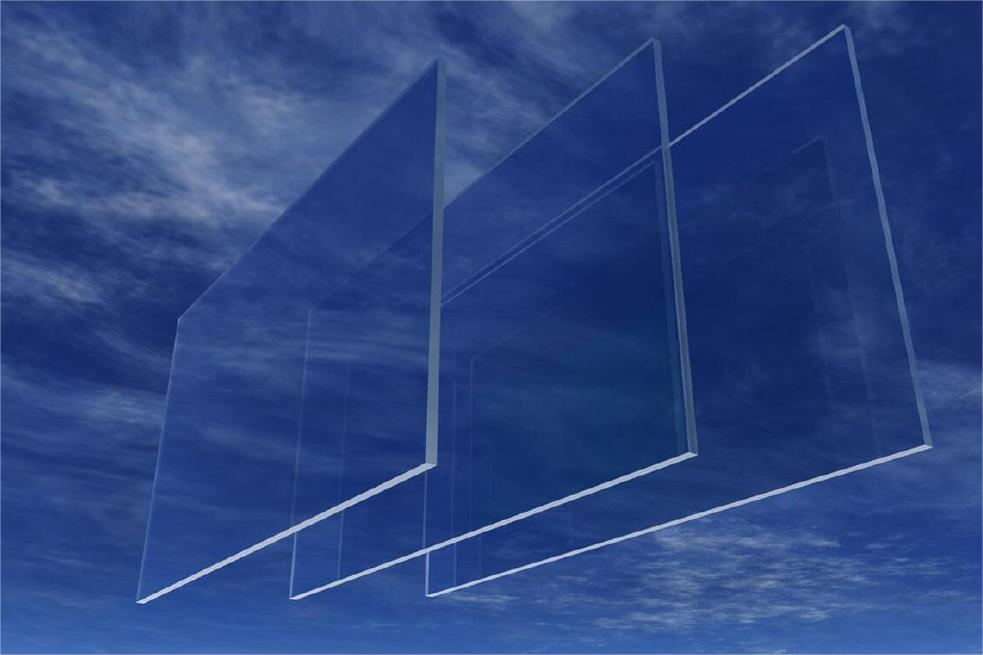

Glass substrates are products that Absolix is commercializing for the first time in the world. Compared to traditional plastic substrates, glass substrates can be made thinner, which helps improve power efficiency and reduces the problem of peripheral warping, making them particularly suitable for high-performance computing (HPC) applications such as AI.

At the same time, the ultra-low flatness of glass substrates can improve the depth of focus in photolithography and good dimensional stability of interconnects, which is very important for next-generation system-in-package (SiP) technology. Glass substrates also provide good thermal stability and mechanical stability, allowing them to withstand higher temperatures and be more flexible in data center applications.

Furthermore, using glass as a raw material to manufacture substrates allows for the packaging of processing chips and storage chips into a single device, resulting in a thinner device and a reduction in energy consumption of more than 30%, as well as fast data processing.

Currently, Absolix is discussing large-scale production of glass substrates with semiconductor giants such as AMD and is demonstrating its wide-ranging application prospects and potential.

Absolics CEO Jun Rok Oh stated in a press release that the proposed funding will enable the company "to fully commercialize our groundbreaking glass substrate technology for high-performance computing and advanced defense applications." According to Prismark, the global IC packaging substrate industry is expected to reach $21.4 billion in size by 2026. And with the entry of major chip giants, the substitution of glass substrate for silicon substrate will accelerate, with the glass substrate penetration rate expected to reach 30% within 3 years and over 50% within 5 years.

Glass substrate manufacturers are an important part of the high-tech supply chain in the United States. This subsidy policy will help enhance the competitiveness of the US glass substrate industry, further reduce production costs, and increase capacity. The US government's move is seen as a challenge to the glass substrate industry in Asia. In fact, Asian countries have invested heavily and rapidly in the glass substrate industry in recent years, posing competition pressure on the US. The US is trying to regain its dominant position in the global display industry through the subsidy policy.

From China's perspective, the US move will undoubtedly increase market competition pressure. In the past decade, China's glass substrate industry has achieved a leap from nothing to something, from small to large. In particular, with the support of policies, China's glass substrate industry has already achieved significant advantages. However, Chinese enterprises need to step up innovation efforts and improve product quality to mitigate potential competition risks in the face of the US subsidy policy.

Although the US subsidy policy may bring some pressure to China's glass substrate industry in the short term, it has positive implications for the global industry in the long run. The competition among countries such as the US, China, etc. in the field will drive technological innovation, improve product performance, and reduce costs, ultimately benefiting consumers. Furthermore, in the context of global technological competition, the Chinese government and enterprises should also pay more attention to technological innovation and talent cultivation to meet the challenges of international competition.

It is worth noting that the development of the global glass substrate industry is not a one-horse race, but a process of joint participation and win-win cooperation among various countries. In the fierce international competition, countries should work together to jointly promote the prosperity of the global glass substrate industry. Chinese enterprises can cooperate with American enterprises to share resources such as technology, market, and talent, achieving mutual benefit and win-win results. In addition, the Chinese government should continue to increase its support for the glass substrate industry, providing a good policy environment for enterprise innovation.

In summary, the US government's provision of $75 million in subsidies to glass substrate manufacturers indicates that the global glass substrate industry will usher in a new round of competition. Faced with international competition, China should keep a clear head and increase its innovation efforts to improve product quality, while seeking cooperation with the US to jointly promote the development of the global glass substrate industry. In the fierce international competition, China's glass substrate industry will undoubtedly achieve greater breakthroughs.