With the rapid development of the photovoltaic industry, the photovoltaic glass capacity is gradually released, and the industry faces new challenges and opportunities. Under this background, photovoltaic glass enterprises have increased their R&D investment and optimized production processes to improve product quality and reduce costs, providing better substrates for photovoltaic modules. This article will analyze the policies, capacity, competitive landscape, and trends of the photovoltaic glass industry to present a new look at the photovoltaic glass industry.

I. Policy Support to Promote the Development of Photovoltaic Glass Industry

In recent years, the Chinese government has attached great importance to the photovoltaic glass industry and has issued a series of policies to encourage its development and innovation. According to data from Minsheng Securities, as of November 30, there were a total of 477 photovoltaic glass production lines in operation nationwide, with a combined daily melting capacity of 96,280 tons, up 31% year-on-year; a total of 85 new photovoltaic glass production lines were added in 2023, with a combined daily melting capacity of 19,400 tons, accounting for 20.15% of the nation's operating capacity.

From the enterprise structure, in 2023, a total of 11 enterprises (groups) completed the expansion of photovoltaic glass production lines, of which 4 were float glass enterprises (Kibing Glass, Changli Glass, Csgholding and China Building Materials). Among the 85 new photovoltaic glass production lines added in 2023, 35 came from float glass enterprises, accounting for 41.18%. From a regional perspective, most of the new capacity was concentrated in Anhui, Fujian, Jiangsu, Jiangxi, and Zhejiang, with Anhui having the most new capacity, mainly consisting of photovoltaic auxiliary material enterprises; Fujian came in second, with most of the increase coming from Kibing Group.

The policies of "Notice on Promoting Synergistic Development of Photovoltaic Industry Chain and Supply Chain," "Implementation Plan for Carbon Peak in Industrial Sector," and "Opinions on Promoting Green Development of Urban and Rural Areas" provide a clear market outlook and a good production and operation environment for the photovoltaic glass industry.

II. Photovoltaic Glass Capacity Gradually Released, Competition Intensifies

As the photovoltaic glass industry develops, capacity is gradually released, and market competition has become increasingly fierce. According to the "Notice on Further Improving the Risk Warning of Photovoltaic Flat Glass Capacity," issued by the Ministry of Industry and Information Technology and the National Development and Reform Commission, the total photovoltaic glass capacity is 26150t/d, of which 8800t/d capacity has received a risk warning. Currently, the photovoltaic glass industry is at the bottom of the cycle, with a high risk of capacity excess. However, under the guidance of policies, photovoltaic glass enterprises have increased their R&D investment, introduced advanced foreign technologies, and expanded production lines to achieve domestication and improve market competitiveness.

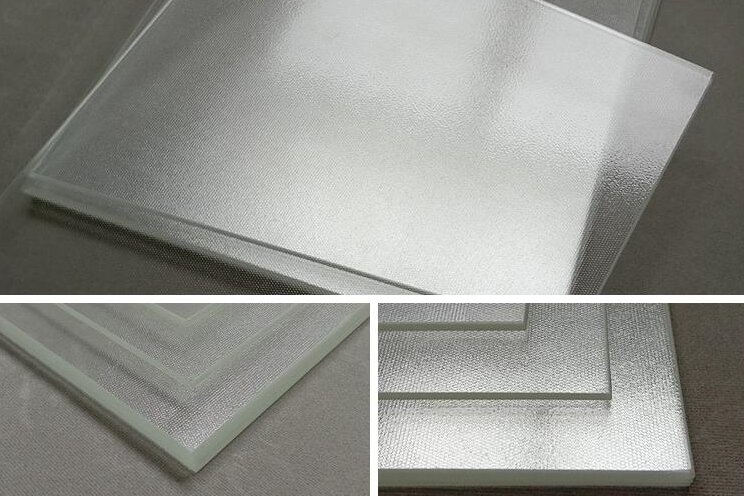

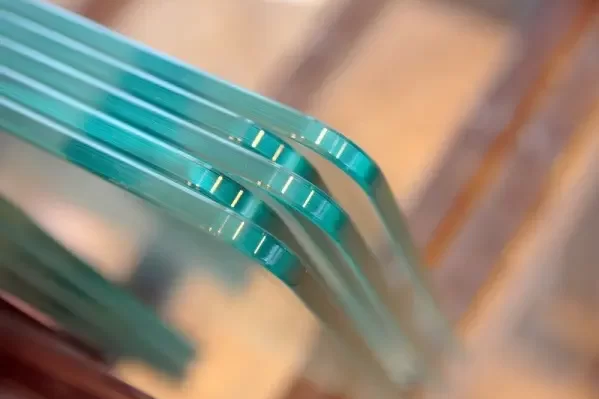

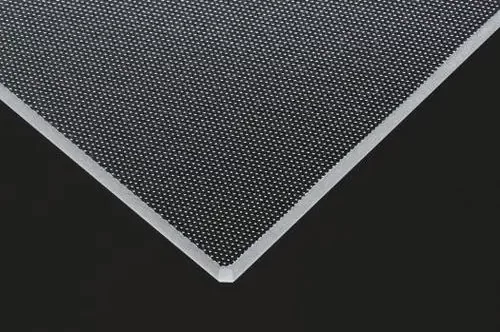

III. Enterprise innovation, enhancing quality and economic benefits of photovoltaic glass

Faced with market competition, photovoltaic glass companies are increasingly adopting technological innovation and management optimization to improve product quality and reduce costs. On the one hand, companies are investing more in research and development to enhance the transmittance, wear resistance, and impact resistance of photovoltaic glass. On the other hand, they are introducing advanced production processes and equipment to improve production efficiency and reduce energy consumption. Additionally, companies are actively exploring the diversified applications of photovoltaic glass in the fields of architecture, transportation, and energy to expand market channels and improve economic benefits.

As of November 2023, the company has a total of 7 photovoltaic glass production lines and an operating capacity of 8200T/D (including super white float glass), ranking third in the industry (behind Xinyi and Fuleite). Of these, Line 2 in Zhangzhou was put into operation in January 2023, Line 1 in Ninghai was put into operation in June 2023, Line 3 in Zhangzhou was put into operation in July 2023, and Line 2 in Ninghai was put into operation in September 2023.

On November 14, the company issued a notice of transferring equity in a wholly-owned subsidiary, proposing to transfer 15.5% and 13.75% of the equity in Fengbin Photovoltaic to the employee equity participation platform and Ninghai Fengbin KeYuan, respectively, which is controlled by the company's actual controller. We believe that this equity transfer will help improve the efficiency of the company's photovoltaic glass business's capital utilization and accelerate the construction progress of Fengbin Photovoltaic project. The 1200T/D project in Shaoxing, Zhejiang and the 2400T/D project in Sabah, Malaysia are expected to be completed and put into operation in 24H1, bringing the company's operating capacity to 11,800T/D.

IV. The Market Demand Continues to Grow

Photovoltaic glass, as an important component of photovoltaic modules, will continue to see increasing market demand. It is predicted that with the advancement of photovoltaic module technology and cost reduction, solar power generation will gradually become one of the mainstream energy sources in the future. At that time, the photovoltaic glass industry will face even greater market demand. In addition, with policies promoting green development in urban and rural areas, the demand for photovoltaic glass in areas such as green buildings and green transportation will also gradually expand.

In conclusion, as photovoltaic glass capacity is gradually released, the industry is moving towards dynamic balance. With policy support and enterprise innovation driving it forward, the photovoltaic glass industry is facing new opportunities and challenges. In the future, photovoltaic glass companies need to continue to increase R&D investment and optimize production processes to provide higher quality substrates for photovoltaic modules and contribute to the sustained development of the solar power industry.