The Float Glass Market is Experiencing a Recovery in Profitability in 2024

Strong economic growth and the booming construction industry in China have led to sustained growth in the demand for float glass in recent years. In 2024, benefiting from policy support and market demand, the profitability of the float glass industry is expected to recover, with companies increasing their investment efforts to inject new vitality into the market.

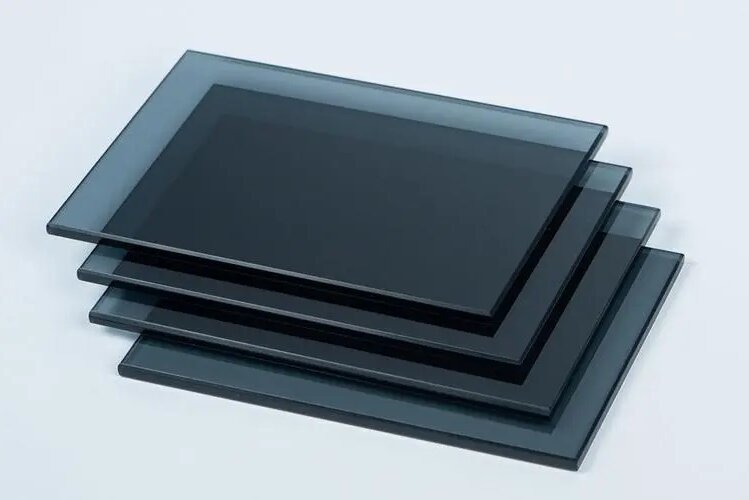

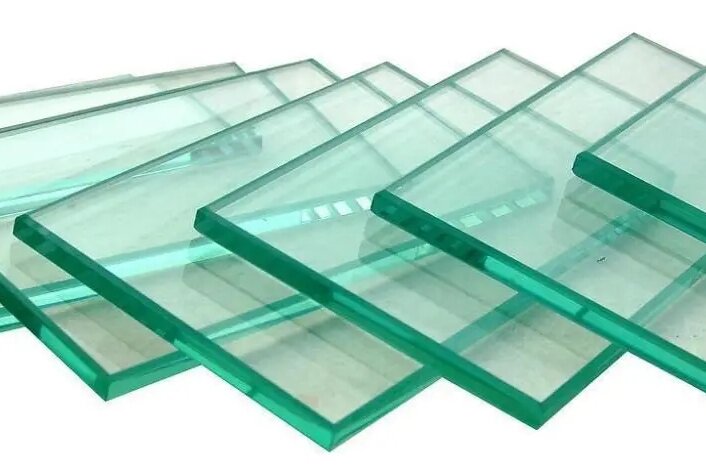

I. Overview of the Float Glass Market in 2024

According to relevant data, the global market size for architectural transparent float glass in 2024 is about 120 billion yuan, of which the Chinese market size is about 60 billion yuan, accounting for 50% of the global market share. In recent years, the demand for float glass in China has been strong, with a growth rate higher than the global average. Benefiting from domestic policy support and market demand, the profitability of the float glass industry has recovered.

[ Margin expansion drives significant improvement in 2H23 profitability

SG Glass achieved a net profit of 5.37 billion yuan in 2023, up 4.6% yoy; 2H23 achieved a net profit of 3.22 billion yuan, up 77% yoy/50% qoq. The accelerated expansion of the float glass business margin was the main reason for the significant improvement in 2H23 profitability. We expect that the float glass industry may face more challenges on both supply and demand sides in 2024, with pressure on the company's margin contraction. We are lowering our 2024-25 EPS forecast by 23%/28% to 1.34/1.36 Hong Kong dollars, predicting 2026 EPS of 1.42 Hong Kong dollars, and lowering our target price by 14.8% to 13.38 Hong Kong dollars, based on a 10x 2024 average P/E, consistent with the average since 2005. Since July 1, 2023, the company's stock has fallen 34%, lagging the HSCEI by about 22%, reflecting the expectation of increasing challenges in the industry's supply and demand. Thanks to scale effects, fine management, and the differentiated advantage of deep processing products, we believe that the company's competitiveness in the industry is solid, and it is expected to enjoy better profitability than its peers.]

2. Policy Support to Help the Industry Recovery

In recent years, the Chinese government has increased its policy support for energy conservation and emission reduction in the construction industry, driving the transformation and upgrading of the construction industry. As an important part of the construction industry, the float glass market demand has also increased. In addition, the government has issued a series of industrial policies to encourage enterprises to increase their R&D investment, improve product quality and performance, providing a good development environment for float glass enterprises.

3. Market Demand Drives Industry Growth

With the acceleration of urbanization and the booming infrastructure construction in China, the application of float glass in the fields of architecture, decoration, and household products is becoming more and more extensive. In 2024, the demand for float glass in China will continue to be strong, providing good development opportunities for enterprises. According to statistics, the demand for float glass in China is expected to grow by around 10% in 2024, and the industry's prospects are bright.

4. Enterprises Increase Investment, Industry Competition is Fierce

Faced with the growing demand for the market, float glass enterprises have increased investment efforts to improve production capacity and product quality. According to information, the total investment in the float glass industry in China in 2024 exceeded 10 billion yuan, providing strong support for the development of enterprises. However, as market competition intensifies, price competition among enterprises has become increasingly fierce, and some enterprises have begun to seek to enhance their competitiveness through technological innovation and product differentiation.

5. Challenges and Opportunities Coexist in the Industry

Although the profit recovery in the float glass market, the industry still faces certain challenges. First, the tightening of environmental protection policies requires enterprises to invest more funds in pollution control during production, increasing production costs. Second, as market competition intensifies, enterprises need to continuously improve product quality and performance to meet market demand. In addition, the industry also has the problem of excess capacity, which needs the joint efforts of the government and enterprises to strengthen macro-control and optimize the structure of capacity.

However, opportunities and challenges coexist, and the float glass industry is facing pressure while also ushering in new development opportunities. With the transformation and upgrading of China's construction industry, green buildings, energy conservation and emission reduction will become new market growth points for float glass enterprises. At the same time, enterprises can stand out in market competition through technological innovation and product differentiation, and achieve sustainable development.

Conclusion:

Looking ahead, as China's economy and society continue to develop, the demand for float glass in the construction industry will continue to grow. Float glass enterprises should increase investment in technological innovation and product research and development to improve product quality and performance to meet market demand. At the same time, enterprises should actively respond to the challenges of environmental policies, strengthen energy conservation and emission reduction, and enhance the overall competitiveness of the industry. With the joint efforts of the government, enterprises and the market, China's float glass industry is sure to usher in a brighter development prospect.